Subscribe To The

Newsletter

Sign up to hear from us about specials, sales, and events.

As we approach the last quarter of 2025, now is the prime time for Minnesota-based employers to get ready for the significant legal and operational changes coming in 2026. Taking proactive steps now will help you hit the ground running next year.

Here are some of the major law changes in Minnesota that you’ll need to be compliant with in 2026 — so let’s prepare during the remainder of 2025.

Meal & Rest Break Requirements: Starting January 1, 2026, employers must provide:

• A paid rest break of at least 15 minutes (or enough time for a restroom break, whichever is longer) for every four consecutive hours of work.

• An unpaid meal break of at least 30 minutes when an employee works six or more consecutive hours.

Front-loading of ESST (Earned Sick & Safe Time): As of January 1, 2026, employers may advance ESST hours to an employee based on anticipated hours for the remainder of the accrual year.

Paid Family & Medical Leave (PFML) Program: Still set to begin January 1, 2026 — with employer obligations around premium payment, employee notices, etc.

Here’s a checklist of actions to take between now and year-end to set yourself up for compliance and smooth operations:

1. Policy Review & Revision

– Audit your employee handbook, PTO/ESST policy, meal/rest break policy, and job-posting practices.

– Update your break-policy language to reflect the upcoming changes (paid rest breaks, 30-minute meal breaks for 6-hour shifts).

– Revise your ESST/PTO policy if you choose to implement the advancement of hours.

– Prepare your PFML strategy: determine how you will manage the premium deductions, who will administer the program, and how you’ll communicate it to employees.

2. Employee Communications & Training

-Inform your supervisors and HR team about the upcoming 2026 changes. Provide training on how to schedule breaks and processing PFML leave requests.

– Communicate to your employees: “Here’s what to expect in 2026.”

– Transparency helps manage change and keeps your culture aligned.

– Update your job-posting templates and train your hiring/recruitment teams now so that when hiring in late 2025/early 2026 they are using compliant language (even though some items span 2025, preparation now avoids last-minute scramble).

3. Operational/Systems Readiness

– Review your time-tracking and payroll systems: ensure you’ll be able to monitor break times, rest periods, meal breaks, ESST accruals and usage, and PFML premium deductions.

– Prepare staffing/scheduling models: If you now provide six-hour + shifts, you’ll need to ensure meals & rest breaks are properly offered.

– Update your budget: anticipate costs associated with paid rest breaks, potential increased leave usage, PFML premiums, etc.

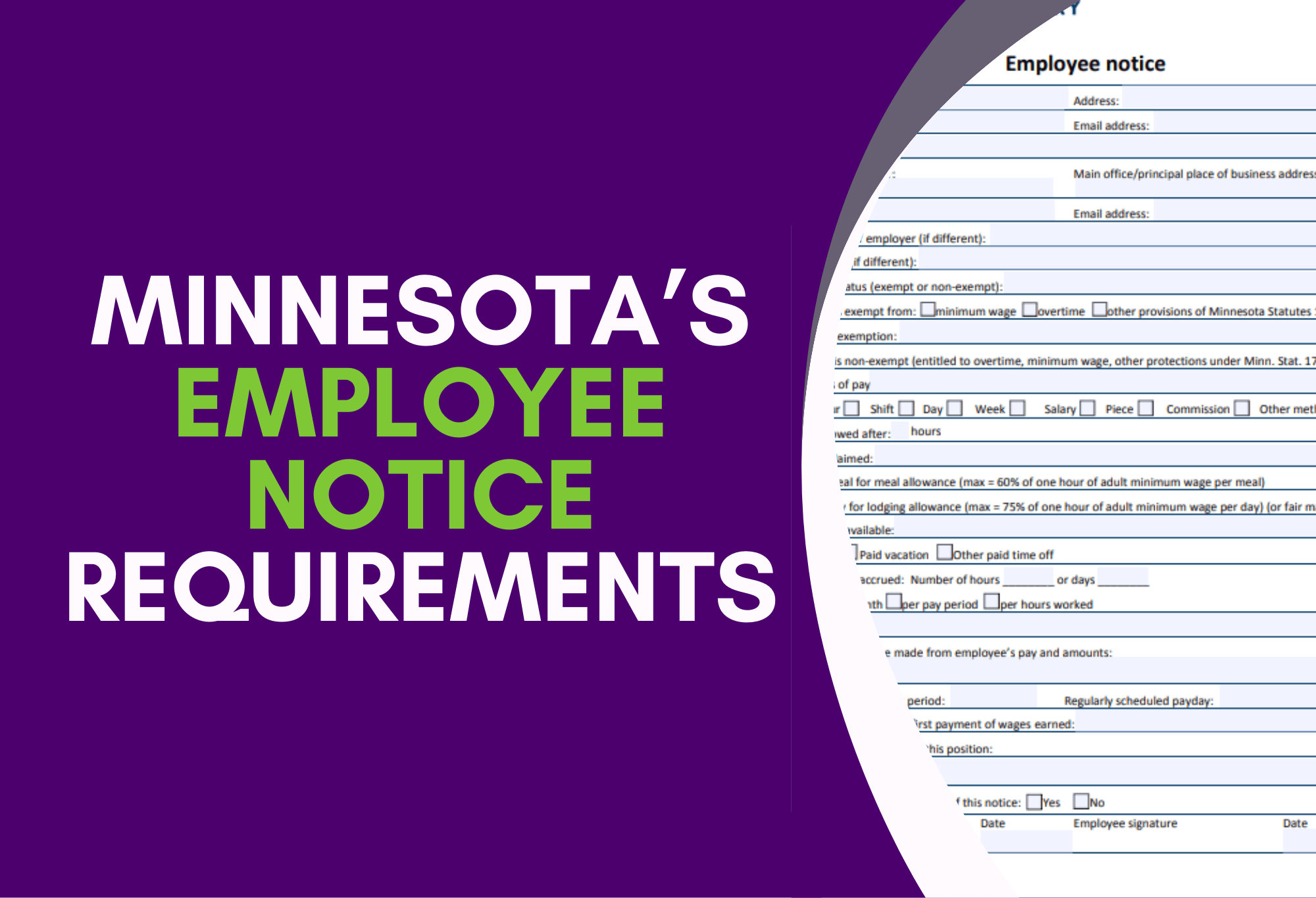

4. Update Notices & Posters

– Check that your workplace notices and posters are current: Minnesota Department of Labor and Industry (DLI) lists updated poster requirements.

dli.mn.gov

– While some posters relate to 2026 changes, start gathering the materials now so you can display them when required.

5. Audit Compliance & Risk

– Conduct an internal audit: Do you have proper records, job-postings containing required disclosures, correct break practices, employment posters up?

– Identify gaps or risk areas now and address them before 2026. For example, ensure you’re able to track where an employee works in the week (for local minimum-wage considerations) and that your job-postings include salary ranges if required (if relevant to size).

– Avoiding last-minute rushes reduces mistakes and compliance risk.

– Shows employees that you’re committed to modern, fair practices (which supports retention and culture).

– Gives you time to test systems, train staff, and budget for changes.

– Helps you align your policies with your business strategy, not just react to laws.

We understand that these transitions can feel overwhelming. At JR Business Solutions we can help by:

– Conducting a policy and compliance audit for your current 2025/2026 readiness.

– Facilitating training workshops for managers.

– Designing your communication plan and employee materials (notices, FAQs, handbook updates).

– Assisting with system & procedural implementation, including time-tracking rules, payroll adjustments, scheduling practices.

Conclusion

The remainder of 2025 presents a valuable window for Minnesota employers to get ahead of major changes coming in 2026. By acting now, updating policies, communicating with your team, preparing your systems and budgeting, you’ll be better positioned to comply, lead, and grow in the year ahead.

Feb 13 2026