Subscribe To The

Newsletter

Sign up to hear from us about specials, sales, and events.

The start of a new year often brings growth: new goals, new plans, and for many businesses, new hires. While onboarding employees is an exciting step, it’s also one of the most critical times to ensure your HR practices are compliant.

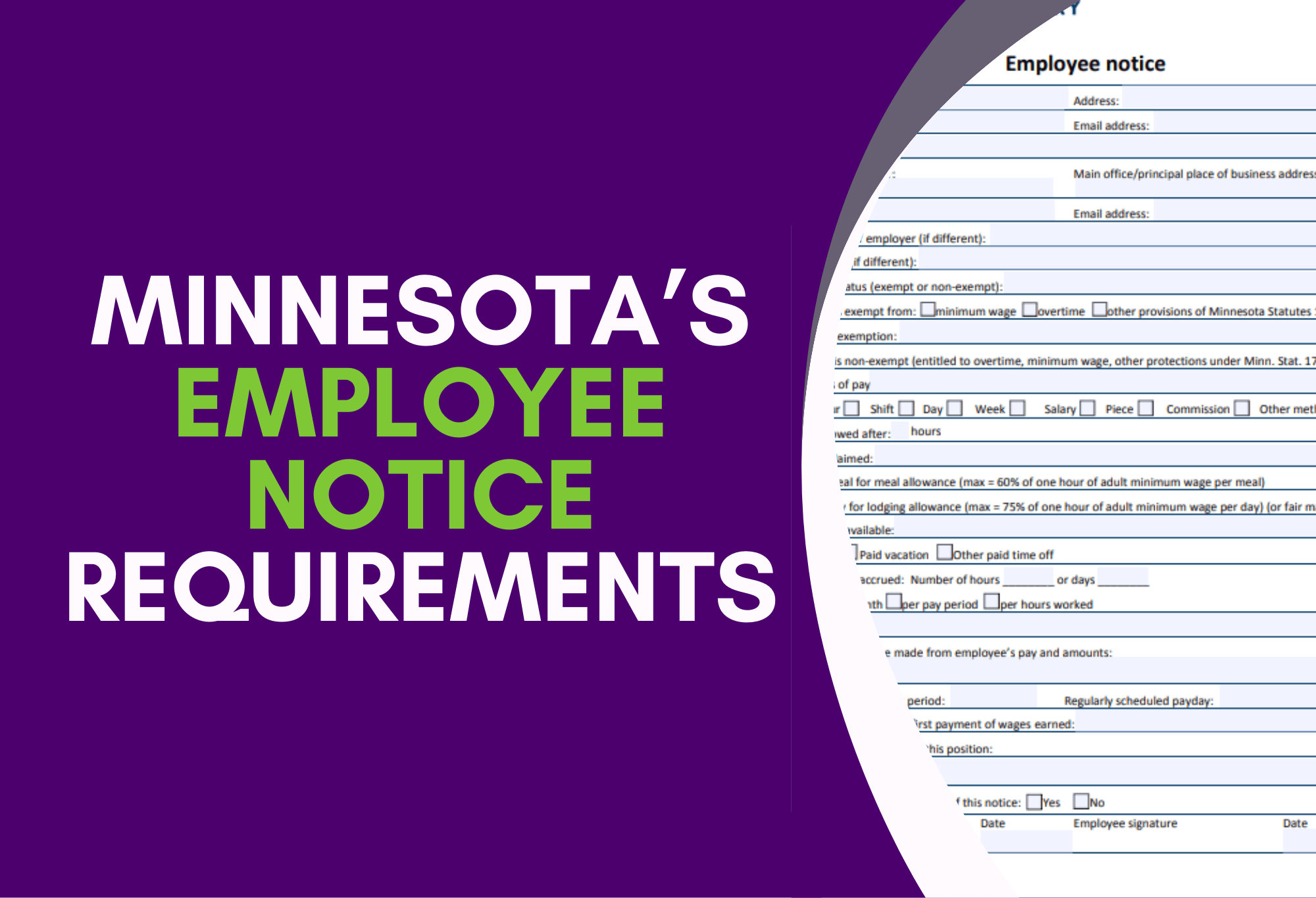

One requirement that continues to be overlooked by many Minnesota employers is the Employee Notice Form, mandated under the Minnesota Wage Theft Law that took effect in 2019.

If you’re hiring in 2026 and beyond, this is something you cannot afford to miss.

Under Minnesota’s Wage Theft Law, employers are required to provide written notice to employees at the start of employment. This notice ensures employees clearly understand their pay, hours, and employment terms, promoting transparency and preventing wage disputes.

The notice must include key information such as:

– Employee’s rate of pay and basis (hourly, salary, commission, etc.)

– Allowances claimed (if applicable)

– Paid time off or vacation policies

– Overtime eligibility

– Paydays and pay schedule

Employer’s legal name and contact information

This form must be provided before or at the start of employment and signed by the employee.

Despite being law for several years, many businesses are still:

– Using outdated onboarding documents

– Relying on offer letters alone with missing required information

– Assuming handbooks cover the requirement

– Unaware the notice is mandatory

Unfortunately, good intentions don’t protect employers from penalties. Failure to provide a compliant notice can expose businesses to fines, audits, and legal risk.

January is an ideal time to audit your onboarding process before hiring ramps up. Catching gaps now is far easier than dealing with compliance issues later in the year.

Ask yourself:

Are we issuing a compliant employee notice for every new hire?

Is the information accurate and updated with current policies?

Are we retaining signed copies as required?

If the answer is “I’m not sure,” it’s time for a review.

At JR Business Solutions, we help Minnesota employers stay compliant without the stress. We can:

– Review or create compliant Employee Notice Forms

– Align your onboarding process with Minnesota law

– Ensure documentation is accurate, consistent, and audit-ready

– Support growing businesses with practical HR solutions

Start the Year Compliant and Confident

New hires should be a step forward, not a compliance risk. Taking the time now to ensure your employee notices are in place can save you time, money, and stress down the road.

📌 Need help reviewing your onboarding documents?

Book a call now.

Feb 13 2026